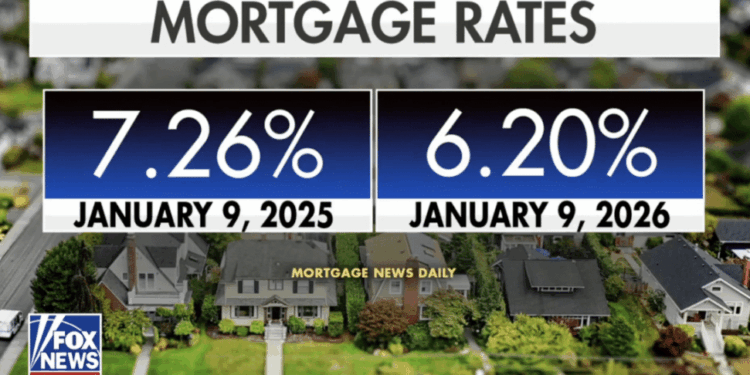

Mortgage rates fell below 6% for the first time in years after President Donald Trump ordered his “representatives” to begin buying $200 billion in mortgage bonds — his latest push to bring down costs for Americans squeezed by the high cost of living.

The average rate for a 30-year fixed mortgage hit 5.99% Friday morning, down from 6.21% Thursday, according to Mortgage News Daily. That’s the lowest the 30-year average has been since February 2023.

And it wasn’t a small glide. Rates typically drift by tenths — even hundredths — of a percent per day.

This was a jolt.

As of Friday, the average 30-year rate is down more than 1% over the past year. The 15-year fixed rate also dropped sharply, sliding to 5.55%. The trigger was Trump’s TRUTH Social post on Thursday.

“I am instructing my Representatives to BUY $200 BILLION DOLLARS IN MORTGAGE BONDS … This will drive Mortgage Rates DOWN, monthly payments DOWN, and make the cost of owning a home more affordable,” Trump said.

Federal Housing Finance Authority chief Bill Pulte followed up with his own post, saying “Fannie [Mae] and Freddie [Mac] are the entities that will do the purchases.” And on Friday at the White House, Pulte said the wheels were already turning.

“We put in a $3 billion buy already,” he said.

Watch the clip below:

🚨 BREAKING: Mortgage rates are PLUMMETING under President Trump, they are now at a 3-year low

Trump is pushing to BAN massive, institutional investors from buying single-family homes to drive prices down

He’s going all in on affordability for 2026! 🇺🇸 pic.twitter.com/xuTfWxmpVv

— Eric Daugherty (@EricLDaugh) January 12, 2026

More over at NBC News:

Mortgage rates just fell below 6% for the first time in years

“The president’s latest affordability push sent 15- and 30-year mortgage rates tumbling.”https://t.co/bYNwmpjK38

— Karoline Leavitt (@PressSec) January 12, 2026