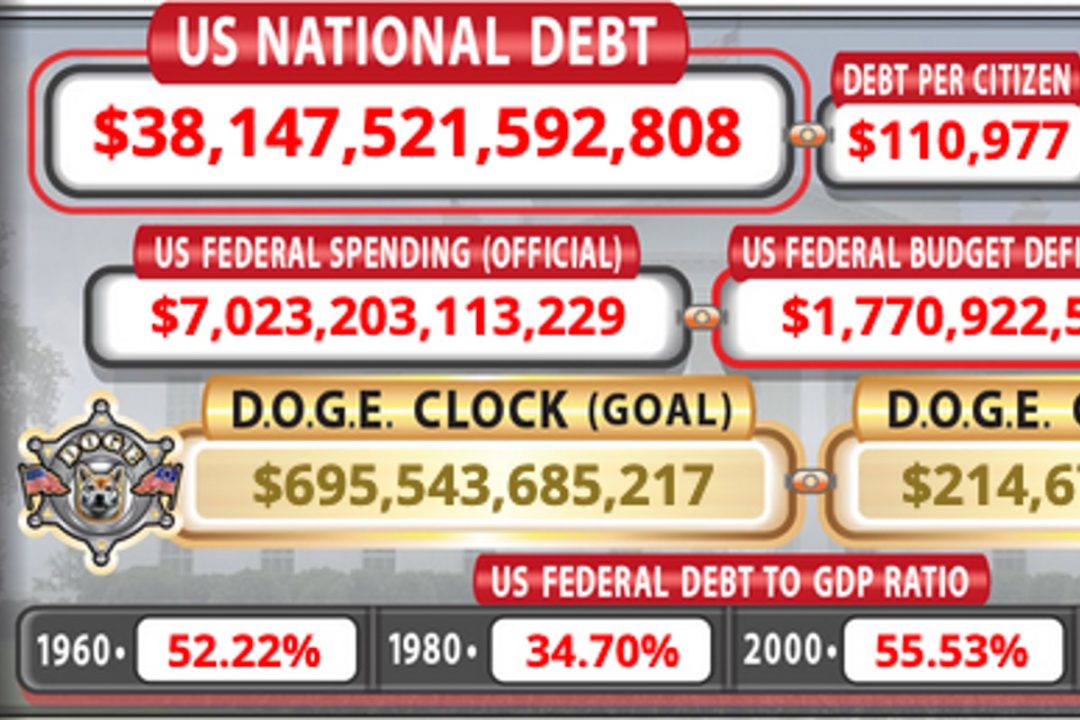

The furor over the federal-government shutdown has distracted from the larger picture of destructive out-of-control spending and debt — and this was demonstrated when the U.S national debt surpassed $38 trillion on October 22.

The Associated Press reports:

It’s … the fastest accumulation of a trillion dollars in debt outside of the COVID-19 pandemic — the U.S. hit $37 trillion in gross national debt in August this year.

The $38 trillion update is found in the latest Treasury Department report, which logs the nation’s daily finances….

The Government Accountability Office outlines some of the impacts of rising government debt on Americans — including higher borrowing costs for things like mortgages and cars, lower wages from businesses having less money available to invest, and more expensive goods and services….

The U.S. hit $34 trillion in debt in January 2024, $35 trillion in July 2024 and $36 trillion in November 2024.

Although the Left, mainstream media, and Establishment think tanks regularly blame supposedly insufficient taxation for America’s fiscal woes, the real culprit is ballooning spending intended to enable the ever-expanding federal government. According to the Treasury Department, federal spending in fiscal 2025 exceeded $7 trillion (compare that to President Barack Obama’s “record” $4 trillion budget proposal in 2015).

Although the sheer size and rapid growth of the national debt by themselves should concern Americans for their nation’s well-being, skyrocketing interest payments on the debt are exacerbating the federal government’s deteriorating fiscal situation.

Jon Miltimore of the Foundation for Economic Education (FEE) noted last year:

A new Bank of America analysis shows that interest payments on the national debt are set to explode in 2024 — rising much faster than the $870 billion annual increase that the Congressional Budget Office recently projected.

Even assuming the CBO’s more conservative projection, the picture is grim.

Analysts at the Peter G. Peterson Foundation estimate that the government will spend $12.4 trillion over the next decade just to service its debt. Financial analysts are flagging these surging interest payments, as well as the eye-popping amount of global debt.

“U.S. government spending rose by $162 billion in the last year just to cover interest on the nation’s debt,” Lauren Sanfilippo, an investment strategist for Merrill Lynch and Bank of America, observed in a video analyzing global debt, which stands at a record $307 trillion.

Unfortunately, the current government shutdown appears unlikely to make a big dent in the size and scope of government. For example, Politico reported, the Department of Health and Human Services has rejected already-modest personnel cuts proposed by Office of Management and Budget Director Russ Vought.

The constitutional aspect of federal spending is often overlooked. It must be specifically authorized by Article I, Section 8 of the Constitution. All federal spending that falls outside Article I, Section 8 — including the vast majority of current spending — is unconstitutional.

The Founding Fathers warned against excessive government debt. Miltimore notes:

In 1797, a year after revolutionary France abolished paper money following a disastrous inflationary experiment, U.S. President John Adams delivered a warning on government debt.

“The consequences arising from the continual accumulation of public debts in other countries ought to admonish us to be careful to prevent their growth in our own,” Adams told Congress.

It’s a speech that lawmakers in Washington, D.C., would do well to read — and quickly.

Contact your U.S. representative and senators, and urge them to slash all unconstitutional federal spending.